Loan Programs

With diverse needs we have the following programs that we specialize in and can customize to suit your needs. Below are general guidelines for your general information and in no way suggest a commitment of terms.

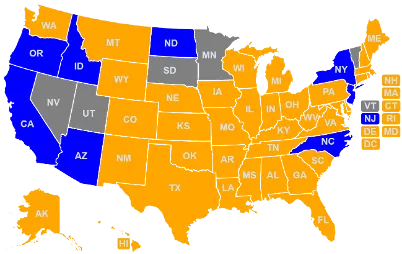

Available States

All Orange states we are happy to help you get the loan you need., we cannot broker deals in the Blue and Grey states but happy to refer.

Bridge Loans

A short-term loan designed to help individuals or businesses "bridge" the gap between the need for immediate funding and the availability of long-term financing. These loans are typically used when a borrower needs quick capital but doesn't yet have the funds needed for a more permanent financing solution.

GUIDELINES:

MAX ALLOWED (with excess first loss):

Max 90% (LTV "As Is")

90% (LTC)

75% (LTV "As Repaired") With Approval

Max 12 Month Loans

Minimum FICO 620

Minimum loan amount$50,000 - Maximum $2M

Fix & Flip Loans

Short-term financing specifically designed for real estate investors who purchase properties with the intention of renovating (or "fixing") them and then selling them for a profit (or "flipping"). These loans provide the capital needed to acquire and rehab the property, with the expectation that the property will be sold quickly after the renovations are completed.

GUIDELINES:

3 Tiers based on risk and experience

% Of Purchase (all 3) 90%

% Of Rehab (all 3) 100%

% Of Max LTC (all 3) 90%

% Of Max ARV (varies) 75%-65%

Experience: 2 Deals/2Yrs (Tier A&B) | 1st Timers Okay (Tier C)

App fee: $197

Credit Requirements: Varies per Tier, no minimum for Tier C

FHA Cap (Loan Amount forTier A&B) | ARV for Tier C

No Inspection (Tier A&B) | Required for Tier C

No Tax Return (Tier A&B) | Required for Tier C

No Well/Septic (Tier A&B) | Required for Tier C

No Impound next years taxes (Tier A&B) | Required for Tier C

*Plus More - Contact us for details

Construction Loans

A specialized type of financing used to fund the building or renovation of a property. These loans are typically used by developers, contractors, or individual homeowners who are building a new home or undertaking a major construction project. Construction loans are different from traditional mortgages because they are designed to cover the costs of construction as the project progresses, rather than being a lump sum loan paid upfront.

CRITERIA:

Collateral: non-Owner occupied single family properties, condos &townhomes

Rates: Starting at 11.29%

Term: 12-24 months

Loan Amount: $100K* - $3M* (*Based on Loan Amount)

Minimum Property Value: $150K** (** As-Completed Value)

Credit Score: 650 Minimum

Max. Allowed Loan Amount: As is - up to 75%

ARV: up to 85%

Leverage Based on Experience: Documented experience in past 3 years

Long Term Rental Loans

Financing designed for real estate investors who plan to purchase, hold, and rent out properties for a steady income stream over an extended period (typically years or even decades). Unlike short-term investment strategies like "fix and flip," long-term rental loans are structured to support the acquisition of rental properties that will generate monthly rental income and build equity over time.

GUIDELINES:

Investor Advantages: Approval based on the Property Cashflow and not your tax returns

Interest Rate: Starts as low as 7.5%

Origination Points: Starts as Low as 2.99%

NO EXPERIENCE REQUIRED

As your portfolio grows, we customize your experience

Loan Amount: Up to $2M (up to 75% LTV)

Credit Score: 660 Minimum

Cross collateral allowed on 2 or more prtoperties. Portfolio loans available on a case-by case basis

Commercial Loans

Financing specifically designed for purchasing, refinancing, or developing income-producing real estate. These loans are used by investors who buy commercial properties such as office buildings, apartment complexes, retail centers, industrial properties, and other real estate that is primarily intended to generate income rather than be owner-occupied.

GUIDELINES:

Features:

Loan amounts up to $7.5M

Up to 85% LTV

First Time investors in commercial are welcome

Credit Score: 660 minimum

Great for qualifying self-employed and small business owners

Property Types:

Apartment Complexes

Multi Family

Mixed use (Residental in nature)

more!

Contact Info

*Not available where prohibited by law, or in states where Innovera Capital does not trade. Loans are available only on non-owner occupied real property. NMLS #2666559

Innovera Capital

Hard Money Made Easy

© Copyright 2024. Innovera Capital, LLC. All rights reserved.